Stamp Duty On Contract Agreement Malaysia

An instrument must be stamped within 30 days of its execution if it is executed inside Malaysia. Rental fees stamp duty and leases can be confusing for anyone moving in or renting property.

How To Stamp The Tenancy Agreement Property Malaysia

Agreements subject to ad valorem stamp duty It has been proposed ad valorem duty will be charged on any contract or agreement made in Malaysia for the sale of any estate equitable estate or interest in any property including stock or marketable securities.

Stamp duty on contract agreement malaysia. Ii For contracts awarded by any party other than the Government stamp duty at Ad valorem rate. Stamp Duty for Loan Agreement The Stamp duty for loan agreements is at a fixed rate of 05 of the loan amount. Stamp duty is generally levied on legal instruments trading instruments and financial instruments.

In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Stamp duty on construction contract instruments Service agreements include construction contract instruments. PENALTY STAMP DUTY An instrument may be stamped within 30 days of its execution if executed within Malaysia or within 30 days after it has been first received in Malaysia if it has been executed outside Malaysia.

Acquisition of all shares of the company as a company as a company who owns the activity. Stamp duty is calculated on the basis of the property assessed by the Stamp Duty Office or the sale price and purchase agreement based on the higher price. Exemption of stamp duty on the instrument of the transfer and loan contract for the acquisition of a dwelling worth 300001 rm30001 to 2500000 RM by Malaysian citizens under the Home Ownership Campaign 20202021.

Stamp Duty Malaysia For Contract Agreement Calculator. RM1 for each RM250 of the annual rent of RM2400. There are two types of Stamp Duty namely ad valorem duty and fixed duty.

6 рядків Ringgit Malaysia loan agreements generally attract stamp duty at 05 However a reduced. The Ministry of Finance has reviewed the situation and issued the following guideline. Tuntutan elaun lebih masa 2020 tuntutan elaun perjalanan kenderaan 2020 types of code switching slideshare turmeric leaf daun kunyit in english tunku abdul rahman putra al haj tuntutan elaun pindah rumah selepas bersara tuntutan perjalanan rawatan perubatan penjawat awam turnitin class id and password.

Non classé Par Nicolas. There are two types of stamp duty ad valorem Duty and Fixed Duty. Stamp Duty On Contract Agreement Malaysia.

Stamp Duty Malaysia 2021 - Commonly asked Questions - Malaysia Housing Loan. Stamp duty is generally levied on legal instruments trading instruments and financial instruments. Stamp Duty On Contract Agreement Lhdn.

Here are some of the most common Stamp Duty questions along with the best way to answer the questions about stamp duty Malaysia 2021. In general term stamp duty will be imposed to legal commercial and financial instruments. Uncategorized By raffytaffy_6ubt0e.

Stamp duty on contract agreement malaysiaAgreements subject to ad valorem stamp duty it has been proposed ad valorem duty will be charged on any contract or agreement made in malaysia for the sale of any estate equitable estate or interest in any property including stock or marketable securities. Paragraph 23 of the 2010 Order remits the amount of stamp duty chargeable under Item 221b in excess of RM50 on any service agreement entered into between a a main service provider and any sub-provider of service where the person awarding the undertaking to the main service provider is a person other than a Ruler of a State or the Government of Malaysia or of any State or local. Ringgit Malaysia loan contracts are generally taxed with a stamp duty of 05.

Stamp duty on foreign currency credit contracts is generally capped at RM 2000. Since construction projects generally involve multiple tiers multiple levels of stamp duty at Ad valorem rate would be levied on the same project. In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act of 1949.

Stamp duty for contracts at the third and subsequent levels will be fixed at RM5000 and any stamp duty paid in excess will be remitted. If the instrument is performed outside Malaysia it must be stamped within 30 days of the first reception in Malaysia. For the ad valorem duty the amount payable will vary depending on type and value of the instruments.

If it is not stamped within the period stipulated a penalty of. A contractor or developer who has been commissioned or authorized by the Minister of Housing and Municipal Government to carry out renovations to an abandoned project. Ringgit Malaysia loan contracts are generally taxed with a stamp duty of 05.

In Malaysia stamp duty is a tax levied on a large number of written instruments defined in the First Schedule of Stamp Duty Act of 1949. Stamp Duty For Contract Agreement In Malaysia Posted by bosquedealimentos_4knasq on April 12 2021 Stamp duty exemption for instruments executed by a contractor or developer ie. This effectively means the imposition of ad valorem stamp duty will be on the contract.

Payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4.

Stamp Duty Malaysia Promissory Note Cheque

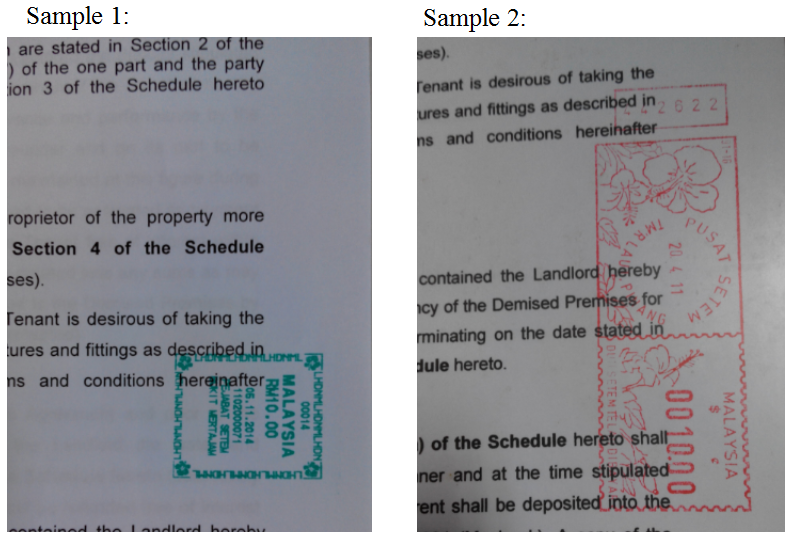

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Legal Fees Calculator Stamp Duty Malaysia 2017 Malaysia Housing Loan 2017 Quotations Price Quote Stamp Duty

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Pdf Public Private Partnership S Contract In Malaysia Some Areas Of Concern In A Land Swap Arrangement

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia